maine excise tax rates

Property Tax Educational Programs. Calculation will be based on.

Visit the Maine Revenue Service page for updated mil rates.

. Multiply your vehicles msrp by the appropriate mil rate. Exact tax amount may vary for different items. On May 6 2022 Florida Governor Ron DeSantis signed a bill establishing 10 yes 10 sales tax holidays.

2020 -- 1350 per 1000 of value. 1 City Hall Plaza Ellsworth ME 04605. Visit the Maine Revenue Service page for updated mil rates.

The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Share this Page How much will it cost to renew my registration. Excise tax is calculated by multiplying the msrp by the mil rate as shown to the right.

The rates drop back on January 1st each year. Some of the sales holidays last less than a week some a few months some two years. The rates drop back on january 1st each year.

Mil rate is the rate used to calculate excise tax. In Maine beer vendors are responsible for paying a state excise tax of 035 per gallon. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021.

Federal Fuel Excise Taxes. Maine Property Tax Institute online - May17-18 2022 Registration. DYER LIBRARY SACO MUSEUM.

16 rows Effective July 1 2009 the full gasoline excise tax rate is imposed on internal combustion. 2021 -- 1750 per 1000 of value. WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax.

YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5. Maine Watercraft Excise Tax Law - Title 36. HOW IS THE EXCISE TAX CALCULATED.

2019 -- 1000 per 1000 of value. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

Groceries and prescription drugs are exempt from the Maine sales tax. 2020 -- 1350 per 1000 of value. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax.

19500 X 0135 26325 WHERE DOES THE TAX GO. The maine state sales tax rate is 55 and the average me sales tax after local surtaxes is 55. The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482.

Welcome to Maine FastFile. MAINE OFFICE OF TOURISM. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

2018 -- 650 per 1000 of value. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Monday-Friday 8AM to 5PM.

Theres a lot to digest. To calculate your estimated registration renewal cost you will need the following information. Well really nine but one of the tax-free periods is a two-in-one The first starts May 14 2022.

Watercraft Excise Rate Chart. The town that collects the excise tax can use it as revenue towards the. 2022 Maine state sales tax.

Welcome to Maine FastFile. As of August 2014 mil rates are as follows. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

The rates drop back on January 1st each year. Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. Real Estate Withholding REW Worksheets for Tax Credits.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Maine Reaches Tax Fairness Milestone Itep Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory.

18 rows Maine Tax Alerts. This information is courtesy of larry. Electronic Request Form to request individual income tax forms.

2022 -- 2400 per 1000 of value. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. 2017 Older -- 400 per 1000 of value.

Counties and cities are not allowed to collect local sales taxes. Departments Treasury Motor Vehicles Excise Tax Calculator. Maine Property Tax School Belfast August 1-5 2022 IAAO Course.

Th For example a 3 year old car with an MSRP of 19500 would pay 26325. Watercraft Excise Tax Rate Table. Boat Launch Season Pass - Piscataqua River Boat Basin.

2022 Watercraft Excise Tax Payment Form. This information is courtesy of Larry Grant City of Brewer Maine. The price of all motor fuel sold in Maine also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

Designed to provide the public with answers to some of the most commonly asked questions regarding the Motor Vehicle Excise Tax. 13 rows Maine Tax Portal. 2022 -- 2400 per 1000 of value.

Federal excise tax rates on various motor fuel products are as follows. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Vehicle Sales Tax Fees Calculator

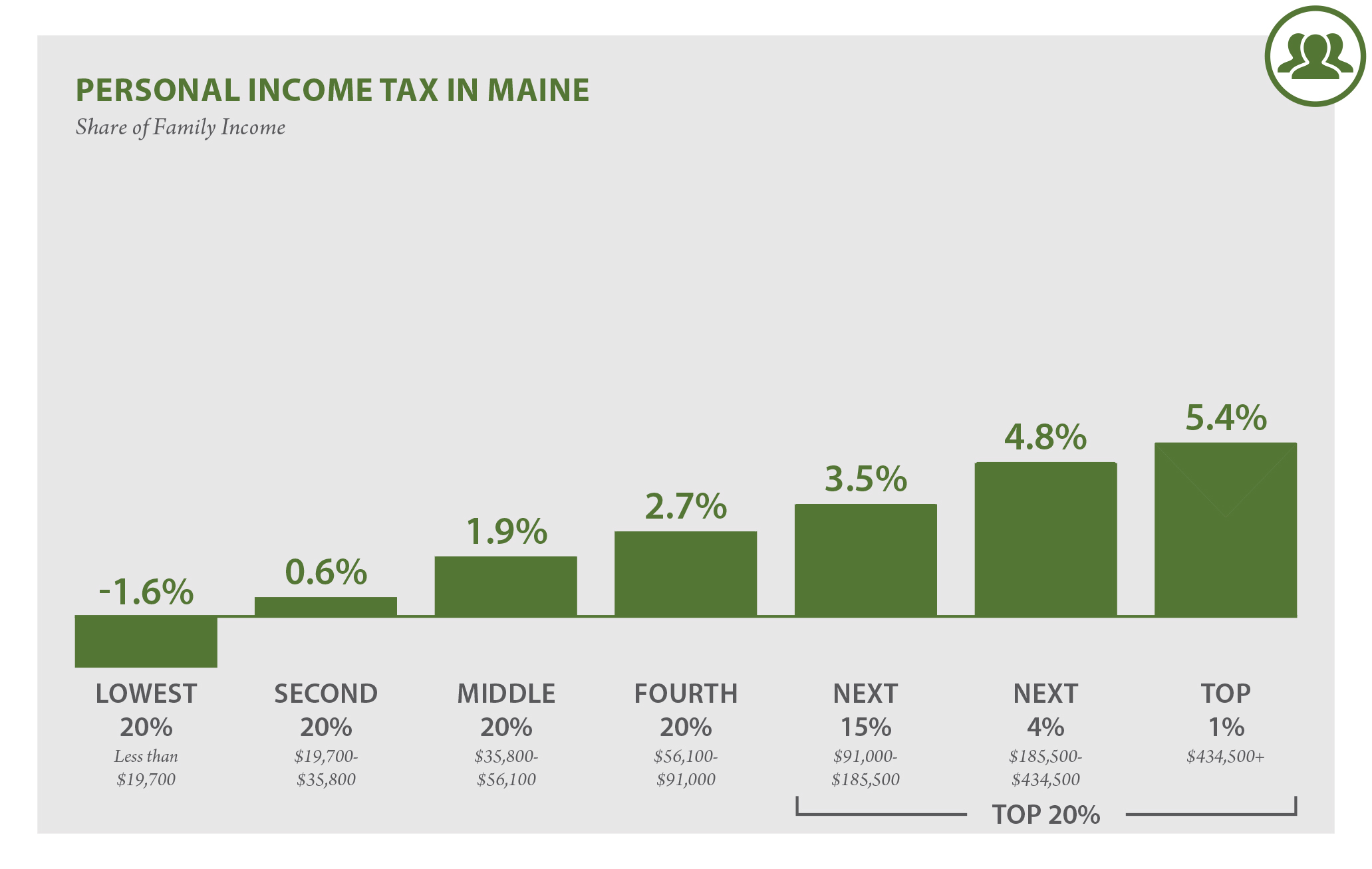

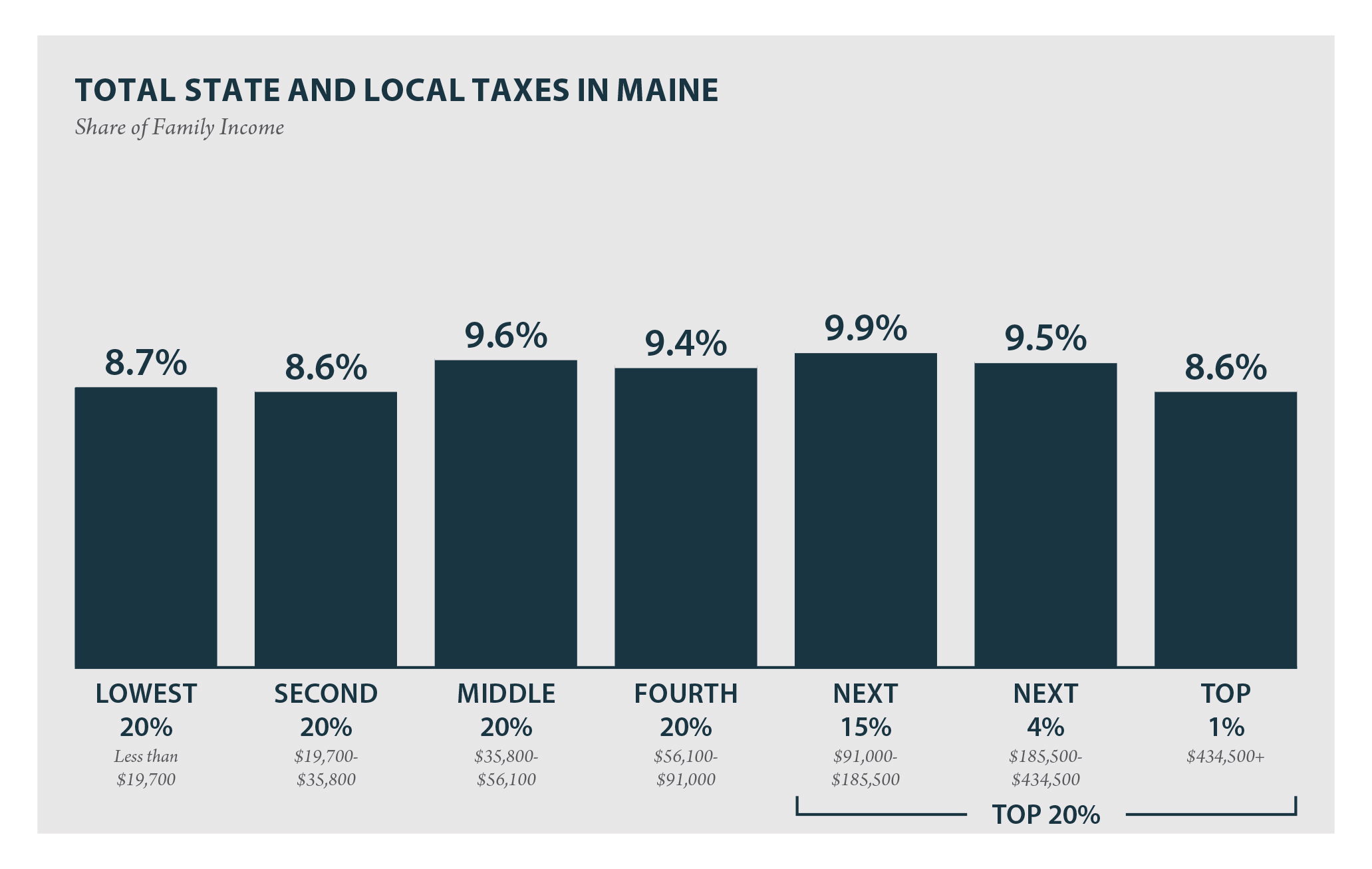

Maine Who Pays 6th Edition Itep

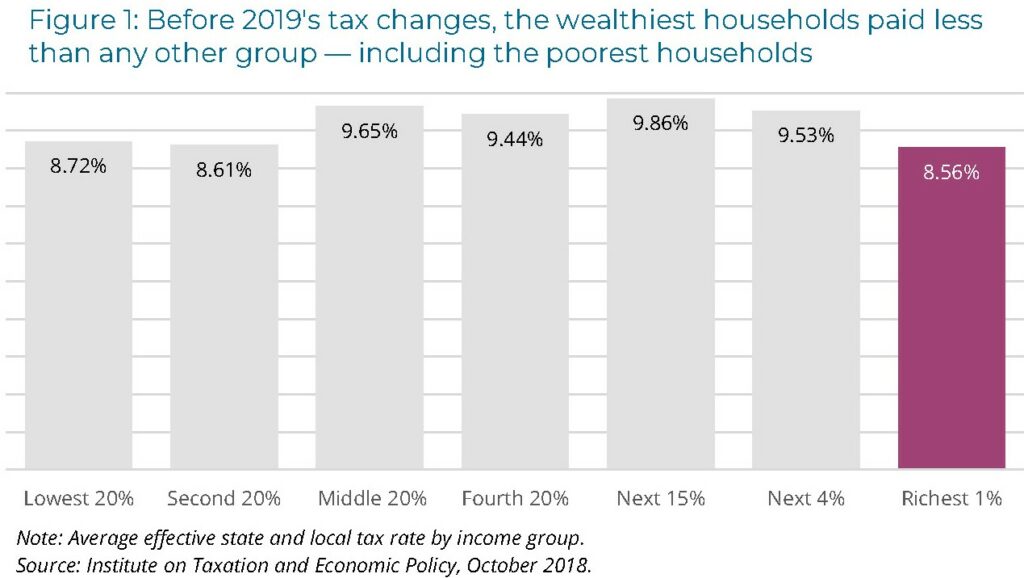

Maine Reaches Tax Fairness Milestone Itep

Maine Who Pays 6th Edition Itep

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Sales Tax Small Business Guide Truic

Maine Reaches Tax Fairness Milestone Itep

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

Maine Vehicle Sales Tax Fees Calculator

A Close Look At Maine S Property Tax Work Off Program Tax Foundation

How To Fix Maine S Transportation Funding Shortfall The Maine Wire

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Car Registration A Helpful Illustrative Guide

Historical Maine Tax Policy Information Ballotpedia

Welcome To The City Of Bangor Maine Excise Tax Calculator